GPUs and CPUs Currently Lead in Market Share, but ASICs will Capture the Lead by 2022, with Expanded Opportunities for SoC Accelerators and FPGAs

May 6, 2019 – The rapid adoption of artificial intelligence (AI) for practical business applications has introduced a number of uncertainties and risk factors across virtually every industry, but one fact is certain: in today’s AI market, hardware is the key to solving many of the sector’s key challenges, and chipsets are at the heart of that hardware solution. Given the widespread availability of AI, it is almost certain that every application in the future will require some sort of acceleration using AI chipsets whether it is in the data center or at the edge. The acceleration could take a wide variety of forms, ranging from a simple AI library running on a CPU to more sophisticated custom hardware. According to a new report from Tractica, the potential for AI is best fulfilled when the chipsets are optimized to provide the appropriate amount of compute capacity at the right power budget for specific AI applications, a trend that is leading to increasing specialization and diversification in AI-optimized chipsets.

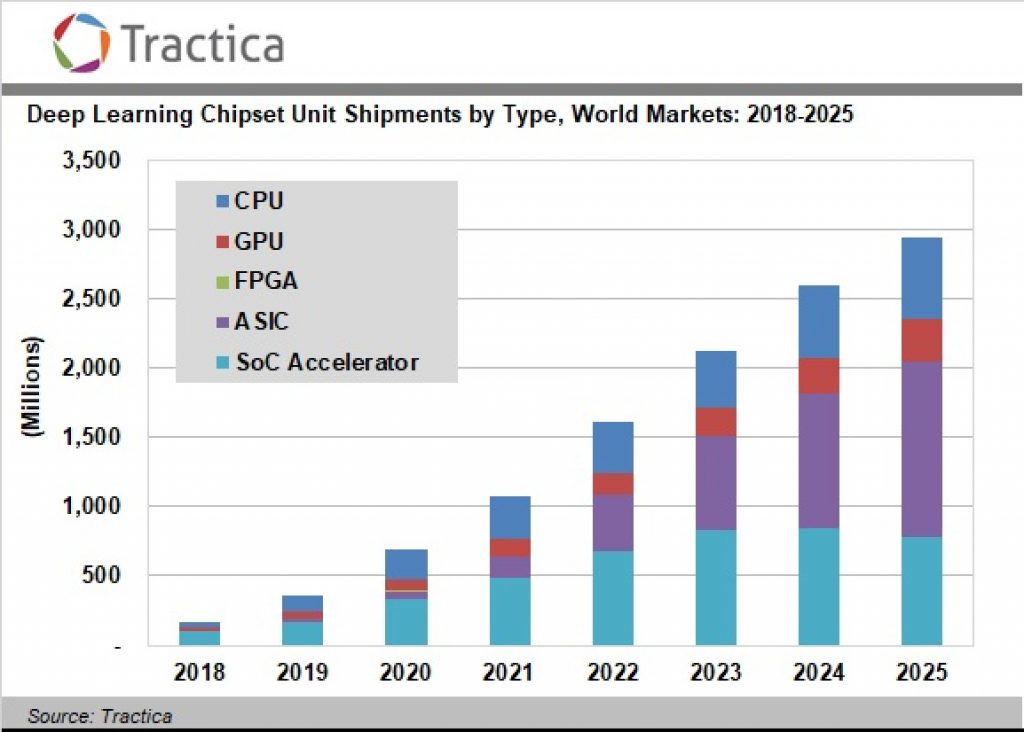

Tractica forecasts that this growth and evolution of the AI market will drive deep learning chipset unit shipments from 164.9 million units in 2018 to more than 2.9 billion units annually by 2025. By the end of that forecast period, the global market for deep learning chipsets will reach $72.6 billion. The market intelligence firm anticipates that application-specific integrated circuits (ASICs) will represent the largest share of total revenue by 2025, followed by graphics processing units (GPUs), central processing units (CPUs), system-on-chip (SoC) accelerators, and field programmable gate arrays (FPGAs).

“During the past 2 years, the deep learning chipset market has experienced a dramatic period of evolution, led by NVIDIA and Intel,” says principal analyst Anand Joshi. “Yet, the upstart ASIC chip companies are somewhat behind in their delivery schedule. Smaller chips aimed at the edge (embedded) market are shipping, but larger chips aimed at the enterprise market are seeing delays. Meanwhile, market validation has already begun for the edge market and should begin for the enterprise market in 2019. A rapid ramp-up in deep learning chipset volumes will start in 2020, and the winners will begin to emerge during that timeframe.”

Tractica’s report, “Deep Learning Chipsets”, assesses the industry dynamics, technology issues, and market opportunity surrounding deep learning chipsets, including CPUs, GPUs, FPGAs, ASICs, and SoC accelerators. The report provides market sizing and forecasts for the period from 2018 through 2025, with segmentation by chipset type, compute capacity, power consumption, market sector, and training versus inference. The study also includes 19 profiles of key industry players. An Executive Summary of the report is available for free download on the firm’s website.